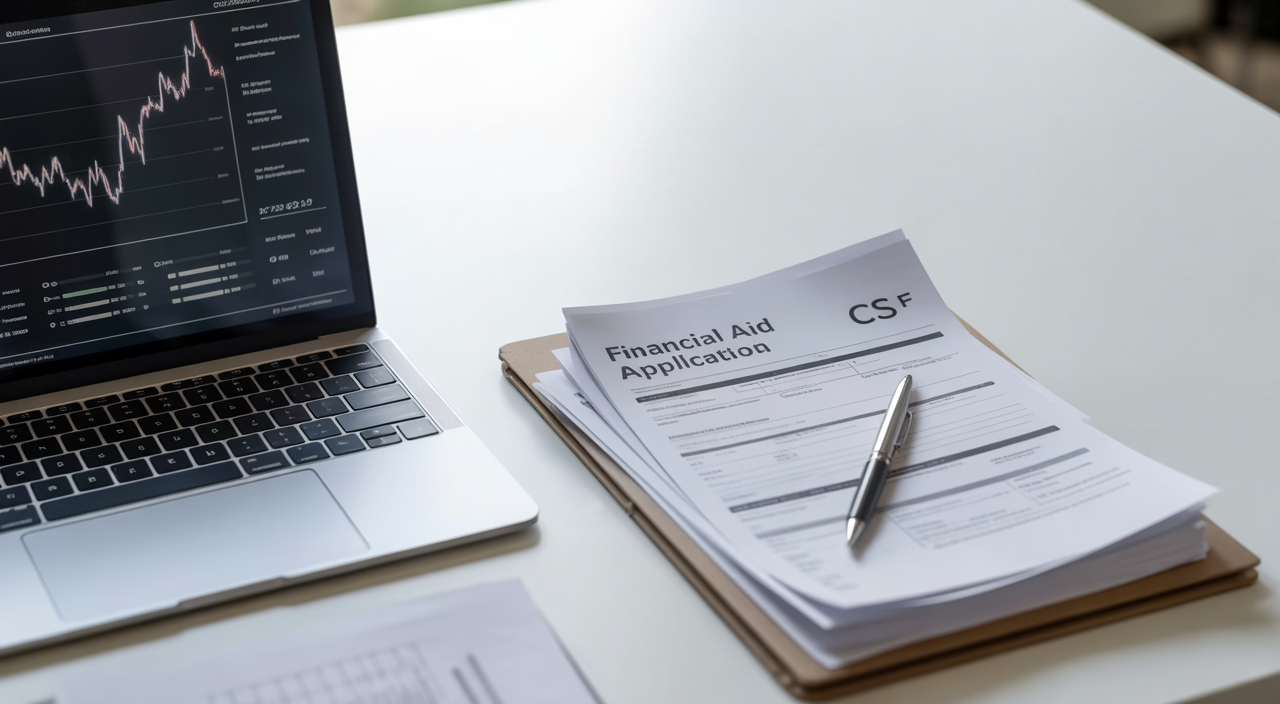

The Ultimate Guide to Financial Aid Planning for College in the USA

Securing a college education is a significant goal, and managing the expenses doesn’t have to be overwhelming. The good news is that financial aid can significantly reduce these costs. Understanding how to navigate the complex world of college financing is key, and this guide is your starting point for effective financial aid planning for college. This comprehensive guide is your essential starting point for effective financial aid planning for college.This article will break down what financial aid is, how it works, and smart strategies to maximize your child’s eligibility. We will simplify the application process and highlight important timelines. By the end, you will feel more confident about your college funding journey.

Why Early Financial Aid Planning is Your Secret Weapon

Many families wait until their child’s junior or senior year of high school to think about college costs. This reactive approach often leaves money on the table. Starting early with financial aid planning for college can make a huge difference. It allows you to make informed decisions that positively impact your child’s aid eligibility.Proactive planning helps you understand the system before you are caught in a rush. It gives you time to adjust your financial situation if needed. This long-term view helps reduce stress and opens up more opportunities for grants and scholarships. Even if you think your family earns “too much” for aid, strategic planning can still uncover significant savings.

Decoding College Financial Aid: Grants, Scholarships, & Loans

Financial aid is money that helps you pay for college. It comes from various sources: the federal government, state governments, colleges themselves, and private organizations. There are generally two main types of aid: “free money” you don’t pay back, and “self-help” aid which includes loans and work-study.

“Free Money” You Don’t Pay Back (Grants & Scholarships)

This is the best kind of aid because it directly reduces the amount you need to pay. It’s essentially free money.

- Federal Grants: These are funds from the U.S. government. They are usually based on your financial need. Examples include the Pell Grant and the Federal Supplemental Educational Opportunity Grant (FSEOG). You apply for these through the Free Application for Federal Student Aid (FAFSA).

- State Grants: Many states offer their own grant programs for residents attending in-state colleges. Eligibility often depends on both financial need and academic performance. Check with your state’s education agency for specific programs.

- Institutional Aid: Colleges offer their own grants and scholarships. These can be need-based, meaning they look at your family’s ability to pay. They can also be merit-based, awarded for academic achievements, talents, or leadership skills, regardless of financial need.

- Private Scholarships: Thousands of scholarships come from private organizations, foundations, and businesses. These can be for anything from academic excellence to unique hobbies or specific fields of study. Searching online databases and local community groups is a good way to find these.

Self-Help Aid (Loans & Work-Study)

This type of aid helps you pay for college but typically involves repayment or earning money through work.

- Federal Student Loans: These loans come from the government and usually offer better terms than private loans. They include subsidized loans (government pays interest while in school), unsubsidized loans (you pay all interest), and PLUS loans (for parents or graduate students). Repayment plans are flexible, and interest rates are often fixed and lower.

- Private Student Loans: These loans come from banks or private lenders. They often have higher interest rates and fewer repayment options. It’s usually best to explore all federal loan options before considering private loans.

- Federal Work-Study: This program lets students earn money to help pay for educational expenses. The government pays a portion of the student’s wages. It’s a great way to gain experience while still attending classes.

Your Step-by-Step Guide to FAFSA & CSS Profile

To unlock financial aid, you must complete specific application forms. The two most important are the FAFSA and the CSS Profile.

Understanding the FAFSA (Free Application for Federal Student Aid)

The FAFSA is the cornerstone of college financial aid. It’s used by the federal government, states, and most colleges to determine your eligibility for various aid programs.

Anyone seeking federal student aid must complete the FAFSA. It asks for information about your family’s income, assets, and household size. The form typically becomes available in October for the following academic year. You will need tax returns and bank statements to complete it accurately. Completing the FAFSA as early as possible is a good strategy.

A significant change came with the FAFSA Simplification Act. This replaced the “Expected Family Contribution” (EFC) with the “Student Aid Index” (SAI). The SAI is a number used to determine how much federal aid a student qualifies for. This new system means some families will see changes in their aid eligibility, so it’s important to understand the new calculations.

The CSS Profile: For Private Institutions

While the FAFSA covers federal aid, some private colleges and universities require an additional form: the CSS Profile. This form gathers more detailed financial information than the FAFSA. It helps these institutions award their own non-federal aid.The CSS Profile might ask about home equity, business values, and other assets that the FAFSA does not. Not all colleges require it, so always check the financial aid requirements for each school your child applies to.

Gathering Your Documents

Before you start either application, have these documents ready:

- Your and your child’s Social Security numbers.

- Your federal income tax returns (from the “prior-prior year”).

- Records of other income earned.

- Bank statements and records of investments.

- Records of untaxed income.

Advanced Strategies for Maximizing Financial Aid (and Minimizing Out-of-Pocket Costs)

Simply filling out forms is not enough. Strategic financial aid planning for college can significantly boost the amount of aid your child receives. This means thinking ahead and understanding how your finances impact aid formulas.

Asset & Income Management

The way you manage your assets and income plays a big role in aid calculations. For instance, the value of your primary home and qualified retirement accounts (like 401ks) usually does not count against you in federal aid formulas. However, certain other assets, like non-retirement investment accounts or rental properties, do.When it comes to planning for your retirement, it’s wise to consider how those savings interact with college costs. For example, 529 plans, which are college savings accounts, are generally treated favorably. They are considered an asset of the parent and have a minimal impact on aid. Timing the sale of assets or large income bonuses can also influence your Student Aid Index (SAI).

Student Aid Index (SAI) Optimization

Understanding the SAI formula is crucial. This formula determines your family’s financial strength. While you cannot hide assets, you can strategically position them. For instance, prioritizing contributions to retirement accounts over taxable investment accounts can sometimes help. Professional advice can guide you through these complex decisions.

Targeting “Aid-Generous” Colleges

Not all colleges are created equal when it comes to financial aid. Some institutions have large endowments and are committed to meeting 100% of a student’s demonstrated financial need. Others offer significant merit scholarships to attract certain students. Researching a college’s financial aid policies before applying can be a smart move.

Negotiating Aid Offers

Did you know you can sometimes appeal a financial aid offer? If your family has special circumstances not reflected in your application (like job loss, high medical bills, or other significant changes), you can reach out to the college’s financial aid office. Presenting a stronger offer from a similar college might also open the door for negotiation.

While these strategies offer a powerful roadmap, navigating the nuances of financial aid planning and optimizing every aspect of your family’s unique situation can be complex. For a personalized strategy that integrates seamlessly with your broader financial goals, consider speaking with an expert about your financial aid planning for college needs.

Smart Moves: Safeguarding Your Financial Aid Eligibility

Even with good intentions, common mistakes can hurt your financial aid eligibility. Being aware of these can save you a lot of trouble.

- Missing Deadlines: This is one of the biggest mistakes. Aid programs, especially grants and institutional scholarships, often have strict deadlines. Missing them can mean losing out on money.

- Incorrectly Filling Out Forms: Even small errors on the FAFSA or CSS Profile can cause delays or reduce your aid. Double-check all information before submitting.

- Not Applying for State or Institutional Aid: Don’t assume you won’t qualify. Many state and college programs have their own criteria, and you might be surprised by what you receive.

- Ignoring Private Scholarships: While some are small, they add up. Dedicate time to searching and applying for private scholarships.

- Taking Out Private Loans First: Always exhaust federal student loan options before turning to private lenders. Federal loans offer better protections, fixed interest rates, and more flexible repayment plans.

- Not Understanding Aid Award Letters: Read each award letter carefully. Understand what is a grant (free money) versus a loan (must be repaid). Compare offers from different schools.

Learning how to simplify complex tasks can also help with managing the stress of financial decisions.

A Proactive Timeline for College Financial Aid Planning

Effective financial aid planning for college is a multi-year process. Here’s a general timeline to guide your family.

High School Freshmen & Sophomores

This is the time to lay the groundwork. Focus on academic success and extracurricular activities. These build a strong profile for merit scholarships. Start discussions about college and career paths. Begin exploring different types of college savings plans, like 529 plans.

Junior Year

Step up your research. Start looking at colleges seriously. Understand their average financial aid awards and scholarship opportunities. Take standardized tests like the SAT or ACT. Attend financial aid nights at your school. This is also a good time to get a rough idea of your family’s potential Student Aid Index (SAI).

Senior Year

This is crunch time. The FAFSA typically opens on October 1st. Complete it as soon as possible after that date. If required, fill out the CSS Profile. Apply for private scholarships. Keep an eye on deadlines for each college and aid program. Once acceptance and aid letters arrive, compare them carefully.

Post-Acceptance

Once you’ve made a college decision, finalize any necessary federal or private student loans. Understand the repayment terms. Keep meticulous records of all financial aid documents and communications.

Take Control of Your College Funding Future

Navigating college costs might seem daunting, but with smart financial aid planning for college, it doesn’t have to be. By understanding the different types of aid, diligently completing applications, and using strategic financial approaches, you can significantly reduce the financial burden. Proactive planning empowers you to make informed decisions and secure the best educational opportunities for your child.Remember, every family’s situation is unique. The more you plan and prepare, the smoother your college funding journey will be.

Frequently Asked Questions (FAQs)

Q1: What is the biggest change in the FAFSA recently?A1: The most significant change is the replacement of the Expected Family Contribution (EFC) with the Student Aid Index (SAI). This new formula changes how financial need is calculated and can impact federal aid eligibility for many families. It’s important to understand how the SAI works for your specific situation.Q2: Does owning a home or having retirement savings affect financial aid?A2: For federal financial aid (FAFSA), the equity in your primary home and assets in qualified retirement accounts (like 401ks or IRAs) generally do not count against you. However, the CSS Profile, used by some private colleges, may consider home equity. It’s crucial to understand which assets are assessed by each application and plan accordingly.

Marin Hùng, a passionate advocate for holistic well-being, is the driving force behind our health-focused platform. With a deep-rooted commitment to promoting a balanced and vibrant lifestyle, Marin brings a wealth of knowledge and experience to our health community. As a dedicated writer and wellness enthusiast, Marin’s insightful articles and expertise are at the heart of our mission to inspire healthier living.

Post Comment